A primer on managing your company’s finances, books, and filing year-end taxes.

Share the Guide

Welcome to the Small Business Guide to Accounting & Taxes. If you’re reading this, you’re probably a business owner, manager, or executive, or you’re familiarizing yourself with the best practices for running a small business (and we thank you for doing your homework!).

Since we work with so many small and medium-sized businesses (SMBs), we’ve compiled the most important steps and tips for managing your company’s finances, from your bookkeeping system to your taxes. Inside, you’ll find information on accounting principles, best practices, bookkeeping software, important tax dates, and more.

The Small Business Administration defines a small business as a company having fewer than 500 employees. With that definition, there are nearly 28 million small businesses in the US and they account for 99.7% of all business in the US! Not a bad chunk for being small and mighty!

There’s a lot of information out there and it can be confusing to know exactly which sets of rules apply to your specific situation, depending on the nature of your business and your state. This guide is provided to outline some basics of accounting and taxes. You should consult a tax professional and certified public accountant (CPA) who is familiar with your state’s laws for official advice.

Contents

⚖️ Accounting

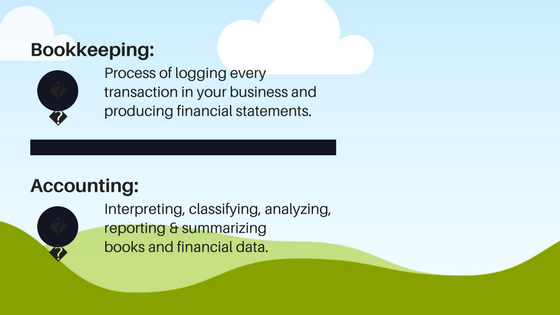

Every business must keep track of its financial accounts including its income, expenses, and assets to have a complete picture of its economic standing. To do so, managers should have a system for tracking all money in and money out of the business, whether that’s done with software or consulting an accounting professional.

In fact, the IRS requires that you keep financial records. Therefore bookkeeping, the process of logging every transaction in your business and producing financial statements, is pretty important. We’ll get further into that below. Read on!

? Accounts

As you prepare to review your company’s financial history and collect all of your important documents, your business should have a set Chart of Accounts to which every transaction is categorized to a specific account. This includes bank accounts, sales accounts, and expense accounts. These are important to delineate because certain transactions are taxed (and deducted, that’s a good thing) differently.

You will rely on this set of accounts when communicating with a tax professional or filing with the IRS.

You can find a paper example here and more information about organizing your accounts.

? Accounting Method

There are two accounting methods that your business may use to categorize transactions: cash method or accrual method. It’s important to know which method is most appropriate for your business and use that method consistently.

The cash method is when transactions are recognized at the point when funds actually change hands. Think of it as exchanging cash and the point and time at which that happens is when the transaction should be recorded on your books. For example, if someone buys a widget from your shop and hands you the money, that transaction is recorded on your income sheet. Someone who places an order but has not paid for it yet would not be reflected on your financial statements. This method is typically used for businesses that do not maintain inventories and do not have a delay between making the sale and receiving the payment.

The accrual method records transactions when the event occurs, although funds may not have been transferred yet. With this method, if someone places an order, it would be listed as a sale and logged on your statements, even if they have not paid for it yet. With this method, you will have accounts for receivables (accounts receivable, or AR) and payables (accounts payable, or AP) for amounts owed.

? Bookkeeping

As we mentioned earlier, the Uncle Sam requires you to keep a set of books for your business. The larger your business, the more valuable it can be to hire an accounting professional to review and assist with your bookkeeping. As a small business, you may be managing your own books, you may have an outside bookkeeper, or you may have an have an in-house bookkeeper.

We recommend using a system such as QuickBooks or Xero to monitor your accounts and financial status. Typically these are also the files you’ll share with an accountant and use to file taxes with the IRS. These systems can import your transactions from online bank accounts and help to consolidate everything into one master system of record, which saves a lot of headaches when done right.

Expenses can be taxed differently so it’s important to track your transactions to the appropriate account. For example, keep track of your meals and entertainment. You should also save and store your receipts. Note that the IRS doesn’t require receipts for expenses less than $75, although it’s still recommended to keep all of your receipts.

Records to keep:

- Receipts

- Bank & credit card statements

- Bills

- Canceled or voided checks

- Invoices

- Proof of payments

- Financial statements from your bookkeeper

- Previous tax returns

- W2 & 1099 forms

- Any other statements which document items of income, deduction, or credit that will be listed on your tax return

When in doubt, save it. We recommend either organizing it in a big file or a cloud drive somewhere. It’s difficult to think back and remember a full year’s worth of activity and transactions, so please bring us these when you meet with your tax professional.

The IRS has some more information on what records to keep.

? Payroll System

As a business, you may have employees, contractors, or freelancers who you will need to pay. To do so, it’s recommended to have a payroll system to facilitate and record these transactions, and more importantly, ensure your tax compliance. Paychex and ADP are two popular payroll services.

These systems help calculate and withhold the taxes associated with paying employees, such as social security tax. Some of these are the employer’s responsibility and some are withheld from the employee’s paycheck, depending on their tax elections.

Additionally, you will need to complete the proper IRS forms for each employee and contractor that your business pays. Employees typically need to complete W-4 and I-9 forms and contractors need to fill out a W-9. There may be additional forms required, so be sure to check with your tax professional.

All tax forms can be found on the IRS website.

? Reconciling Your Books

Since your business is likely using a number of systems and different sources of transactions including your bank accounts and payment processors, it’s helpful to connect all the dots together on a regular basis. This is called reconciling your books when a bookkeeper takes all of your financial statements from your different accounts and makes sure they line up. This helps to identify any inconsistencies and catch any issues before it’s too late. We recommend doing this at least on a monthly or quarterly basis.

? Reports

Your financial statements and reports serve as a way to see the big picture of your finances. These standardized documents are meant to compile all of your accounts and transactions into a common format.

The two most common financial statements are your Profit & Loss Statement (also known as a P&L or income statement) and your Balance Sheet. These are useful for communicating financial information about your business and are also necessary to file your year-end taxes.

A Profit & Loss Statement is a financial document that reports the financial performance of a business over a range of time by summarizing its revenues and expenses. This statement lists all of the sales made and expenses incurred during an accounting period.

A Balance Sheet is a statement that summarizes a business’s assets, liabilities, and equity at a specific point in time. It serves as a snapshot of the company and provides insight into what the company owes, is owed, and any investments.

?? Taxes

In the US, taxes are collected at the federal, state, and local government levels. These taxes are imposed on personal income, business payroll, property, sales, capital gains, dividends, imports, estates and gifts, along with other fees. The amount owed is calculated based on the net income of the entity, being an individual or corporation, and meaning that income is reduced by expenses incurred, called deductions.

? Entity Type

The tax requirements for your business will depend on the type of entity as which it is registered. Basically, businesses must pay taxes on their net profit, although that may be simple or rather complex depending on the nature of the business.

The types of business entities:

- Sole Proprietor

- Partnership

- Limited Liability Company (LLC)

- S Corporation

- C Corporation

As a small business, you are likely one of the first four and we will focus on those types of entities.

Sole proprietors, partnerships, and LLCs are subject to income tax at the individual level and are subject to the self-employment tax. These entities have “pass-through taxation” where the individuals are taxed, not the entity.

A sole proprietorship is the default business type of no business entity is registered with the state. A partnership must be officially registered with the state and should file a Form 1065 where individual partners receive a Schedule K-1. An LLC will pay taxes either as a single proprietorship or as a partnership, depending on if there is one of more members. If you’re a corporate or elect to treat an LLC as so, then you must file a separate corporate tax return Form 1120.

⛔️ Deductions

A tax deduction is a reduction of income that is taxable, usually due to a business expense and incurred to produce income. Deductions, exemptions, and tax credits are different in that exemptions and deductions lessen taxable income, whereas credits reduce tax.

Common tax deductions

- Employee pay

- Taxes

- Depreciation

- Automobile expenses

- Meals and entertainment

- Home office

You’ll need to log proof of every deductible transaction which you plan to claim on your tax filings. For the Full list of potential business deductions, see the IRS Publication 334: Tax Guide for Small Businesses. Some businesses are also eligible for general business tax credits.

Discuss your deductions with a tax professional to confirm which qualify.

? Estimated Taxes

Small businesses should pay estimated taxes to the IRS if they expect to owe taxes of $1,000 or more for the year. Paying estimated taxes to the IRS will help to avoid penalties and lessen the year-end burden at tax time. Make sure to plan accordingly and work with your tax professional to plan ahead.

These are typically quarterly payroll, sales, and income tax reports and estimated taxes which many states require to be filed and paid. Be sure to check-in with your tax professional quarterly to make sure you’re all set.

? Due Dates

Small businesses will file their tax returns on a Schedule C with their personal tax returns (Form 1040). Therefore they are due on April 15th every year, the same date as personal returns are due.

If you’re filing as a corporation, the due date is March 15th.

Check out our yearly tax calendar below.

? Tax Calendar

| Date | Individual/

Business |

What’s Due | Forms |

| January | |||

| 17 | Individual | Estimated tax payment for previous year, installments | Form 1040-ES |

| 31 | Individual | Estimate tax payment for previous year, option but not required, to file tax return to fulfill tax estimate | Form 1040 |

| 31 | Business | Provide annual information statements to the recipients of certain payments you made in the prior year.Such payments may include dividends, interest, royalties, compensation for independent contractors, debt cancellation, prizes, and awards. | Form 1099 |

| 31 | Business | File Form 1099-MISC for non-employee compensation that you paid in the prior year. | Form 1099-MISC |

| February | |||

| 15 | Individual | If you claimed an exemption from withholding tax last year on the Form W-4 (Employee’s Withholding Allowance Certificate) that you gave your employer, you must file a new Form W-4 by this date to continue your exemption for another year. | Form W-4 |

| 28 | Business | File information returns (e.g., Forms 1099) for certain payments you made in the prior year. (the deadline for giving the recipient these forms generally remains January 31). | Forms 1099 |

| March | |||

| 15 | Business | Partnerships: File previous year tax return. Provide each partner with a copy of Schedule K-1, or file an extension. | Form 1065 |

| 15 | Business | S Corporations: File prior year income tax return (Form 1120S) and pay any tax due. Provide each shareholder with a copy of Schedule K-1, or file an extension. | Form 1120S |

| April | |||

| 15 | Individual | File previous year’s income tax return and pay any tax due, or file an extension.

If you are not paying your current year income tax fully through withholding, pay the first installment of your current year estimated tax. |

Form 1040 |

| 15 | Business | Corporations: File prior year income tax return and pay any tax due, or file an extension and pay what you estimate you owe on your return. | Form 1120 |

| 15 | Business | Corporations: Deposit the first installment payment for current year estimated income tax. | Form 1120-W |

| June | |||

| 15 | Individual | U.S. citizen or resident alien living and working (or on military duty) outside the U.S. and Puerto Rico, file your prior year income tax return and pay any tax due or file an extension. | Form 1040 |

| 15 | Individual | If you are not fully paying your current year income tax through withholding pay the second installment of your estimated tax. | Form 1040-ES |

| 15 | Business | Corporations: Deposit the second installment payment for current year estimated income tax. | Form 1120-W |

| September | |||

| 15 | Individual | If you are not fully paying your current year income tax through withholding pay the third installment of your estimated tax. | Form 1040-ES |

| 15 | Business | Partnerships: Extensions of prior year tax return due | Form 1065 |

| 15 | Business | S Corporations: Extensions of prior year tax return due | Form 1120S |

| 15 | Business | Corporations: Deposit the third installment payment for current year estimated income tax. | Form 1120-W |

| October | |||

| 15 | Individual | Individuals: Extensions of prior year tax return due | Form 1040 |

| 15 | Business | Corporations: Extensions of prior year tax return due | Form 1120 |

| December | |||

| 15 | Business | Corporations: Deposit the fourth installment payment for current year estimated income tax. | Form 1120-W |

*If one of these dates falls on a weekend or holiday, the due date will be moved to the next business day.

Share the Guide